New Survey of Former Federal Reserve Officials and Staff Reflects Concerns About the Economy

Conducted by Jon Hilsenrath, a former Wall Street Journal economics writer and visiting scholar at Duke University, in partnership with the Duke Department of Economics, the survey gathers predictions from former Federal Reserve officials and staff about economic indicators and anticipated actions by the U.S. central bank.

A new survey of former Federal Reserve officials and staff members has found growing concern about economic risks including recession, stagflation and higher inflation. Respondents to the survey see the U.S. economy facing slower growth in output, higher inflation, higher unemployment and slightly higher short-term interest rates than Federal Reserve officials projected in December 2024. The nation’s central bank will be updating its own quarterly economic forecasts in conjunction with a policy meeting this week, March 18 and 19.

The survey, conducted by Jon Hilsenrath, a former Wall Street Journal economics writer and visiting scholar at Duke, in partnership with the Duke Department of Economics, includes insights collected between March 10 and 15 from 21 former Fed governors, regional bank presidents and staff members. Former officials are asked to make the same projections about interest rates and the economy that officials make, in addition to answering some special, topical questions.

Hilsenrath, who is also founder of the economic advisory firm Serpa Pinto Advisory, said he hopes the survey will help explain and demystify the work of the Federal Reserve, which is the object of much attention in finance, academia, politics, media and economic policy circles. The central bank’s decisions about interest rates and its $6.8 trillion portfolio of loans and securities have important implications for inflation, growth, asset prices and financial stability.

“When I covered the Fed as a reporter and editor, I always thought it would make sense to try to get ahead of the Fed's quarterly Summary of Economic Projections to have a sense of how the Fed’s thinking about the economy and interest rates was changing. I also understood there was a vibrant community of former Fed insiders who I often tapped for views on the Fed,” Hilsenrath said. “The idea for this survey was a marriage of those two thoughts — tapping former Fed insiders and trying to get ahead of the Fed's own forecasts by asking former officials where it was heading.”

View the complete survey report for more details. Among the key findings:

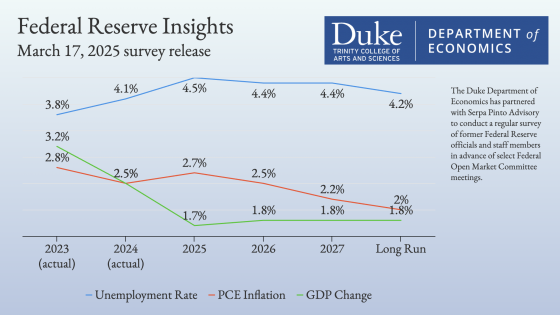

- Economic Outlook: These former officials and staff predict U.S. real gross domestic product, a measure of national output, will grow more slowly this year and the next than the Fed forecast at its December meeting, and inflation will be higher than what the Fed anticipated three months ago.

- In December the Fed’s median forecast for GDP growth was 2.1% for 2025 and 2% in 2025. The median projection in the survey included GDP projections of 1.7% and 1.8%, respectively, this year and next. Inflation estimates were marked up to 2.7% and 2.5% respectively in 2025 and 2026, compared to the Fed’s December forecast of 2.5% and 2.1% this year and next. Core inflation estimates, excluding volatile food and energy prices, were revised up. Unemployment estimates were modestly higher.

- Inflation: No one who responded to the survey expects inflation to reach the Fed’s 2% target in 2025 or 2026, with about a quarter of respondents predicting inflation will top 3% this year and next.

- Interest Rates: Respondents do not expect the Fed to have much leeway to reduce interest rates because of the higher trajectory of inflation. These former officials and staff members said an appropriate short-term interest in 2025 will be between 4% and 4.25%, meaning one rate cut from present levels, not two reductions this year as the Fed projected in December, with one additional quarter point rate reduction in 2026.

- Uncertainty: A number of former Fed officials and staff members expressed high levels of uncertainty about the economy and economic policy, tied to the Trump administration’s trade agenda, which includes aggressive use of import tariffs. Tariffs could push up consumer price levels, and also create unknowns for businesses and households about how the cost of living and doing business will change.

- “The degree of uncertainty surrounding this forecast is unusually high,” one participant said. “Federal policy has been highly volatile, making it hard to predict the course of tariffs, immigration policy, and the soon-to-come tax cuts. The direct effect of policy uncertainty is curtailing private sector activity now. Because of the uncertainty surrounding policy moves, the ultimate net effect of these policies on the economy is particularly hard to gauge.”

“The Fed is in a challenging spot,” Hilsenrath said. “Slowing growth and a rise in unemployment could increase pressure on the central bank to lower interest rates to support the economy. But elevated inflation leaves it potentially hamstrung.”

The survey also asked these former Fed officials and staff members to offer suggestions on the Fed’s “Statement on Longer-Run Goals and Monetary Policy Strategy," which guides the Fed’s monetary policy decisions and is currently under review inside the central bank. Many survey participants said the Fed should drop or revise its “flexible average inflation targeting,” or FAIT, approach to interest rates. Under this approach, the Fed has said it is willing to run inflation above its 2% objective for some period of time following periods in which inflation runs persistently below 2%.

Several people saw this framework, which was last updated in 2020, as an asymmetric bias against low inflation. “The Fed should announce that it is abandoning its FAIT approach and will react in a symmetric manner to trend inflation running above or below target,” one person said. Another person likened the Fed’s ability to fine-tune the economy to the steering precision of cars in the early 1970s, i.e. dangerously imprecise.

Read the full survey report for more results and more detailed analysis of the responses.

Hilsenrath said the central bank is an object of constant fascination and misunderstanding. “Its decisions about interest rates have large effects on the economy because these decisions affect the cost of borrowing, spending, and investing. It also plays a critical role in ensuring financial stability as a lender of last resort to banks and other financial institutions,” he said. “I hope this survey helps to inform public debates about the Fed, which is highly influential and widely misunderstood.”

The partnership with Duke’s Department of Economics is a natural fit — Hilsenrath is a Duke alum and remained connected to the university during his time as a journalist, including serving on the advisory board to the student-run Duke Chronicle and visiting campus as a guest lecturer. The partnership took shape in part through his connection to Ellen Meade, also a Duke alum who joined the Economics Department faculty as a research professor in 2022 after 25 years at the Federal Reserve and 12 years in academia.

Meade’s arrival at Duke, like the survey partnership, was part of a broader effort by the Economics Department to present students with a more expansive view of the discipline and its applicability. The department has broadened its course offerings and co-curricular opportunities to better reflect the study and implementation of economic policy.

“This new collaboration is an opportunity to share with our students a closer look into the factors that impact Federal Reserve decisions and provides new data to deepen their understanding of monetary policy,” said Professor James Roberts, chair of the Department of Economics at Duke. “More broadly, it provides another tool for members of the media and others tuned into actions of the Federal Reserve to better anticipate what changes might be coming and what factors are driving those changes.”

The survey will be conducted leading up to the March, June, September and December meetings of the Federal Open Market Committee, with survey results to be released several days before each meeting. Former officials and staff were granted anonymity to encourage participation in the survey. Interested in receiving future releases from the survey? Join the mailing list.